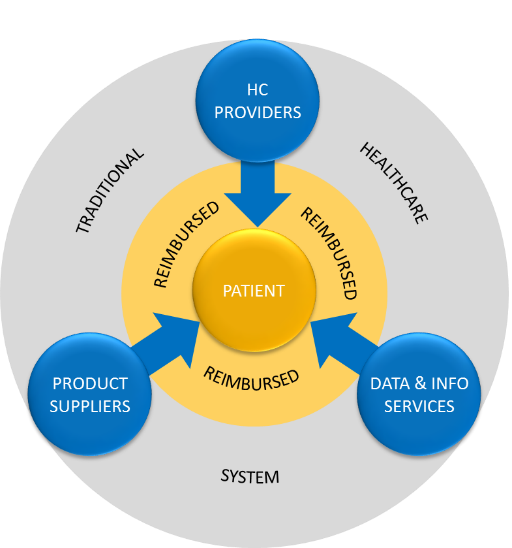

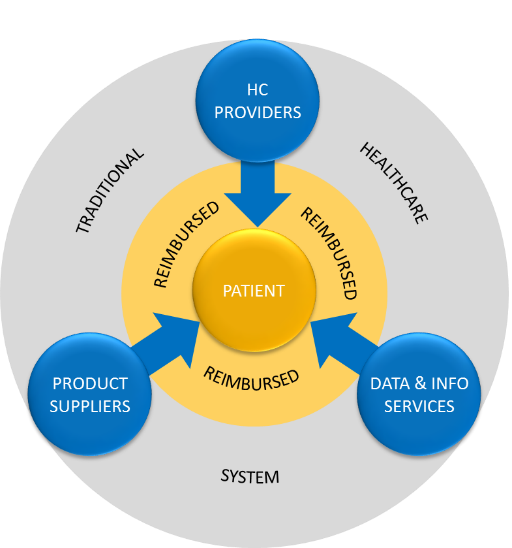

In today’s healthcare market, patients receive products, services and information from various stakeholders in a separated manner, even budgets are split. This results in inefficiencies, lack of communication and transparency, and confusion amongst patients. There is a clear need for, and value to be gained by, the provision of total healthcare solutions to patients around specific (chronic) disease areas.

In a complex and regulated eco-system like healthcare, composed of many different stakeholders, future outlooks are sometimes hard to make and changes are normally relatively slow. However considering multiple trends, instead of being conflicting, they all add up to a similar point at the horizon. The healthcare industry is indeed moving from separated delivery of products, services and information (see figure 1) towards providing total healthcare solutions. A company like Fresenius already started this in dialyses long time ago, whereas Medtronic is actively moving into diabetes integral care, marked by their recent (April 2015) acquisition of research clinic Diabeter. But also non-traditional players have moved, or are moving, into the healthcare domain.

However the notion of integral disease solutions and propositions has serious consequences for healthcare stakeholders and funding mechanisms. Two fundamental questions arise:

- Who is going to deliver these integral solutions?

- Who is going to pay for (elements of) these solutions, especially when not evidence based but still very convenient for the patient?

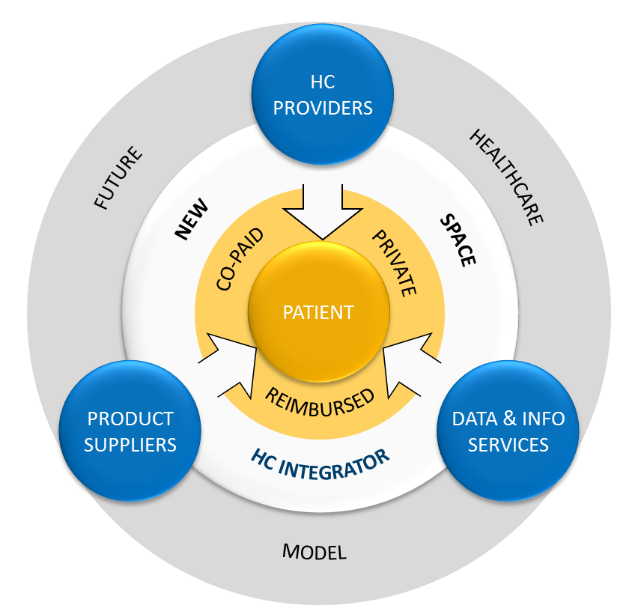

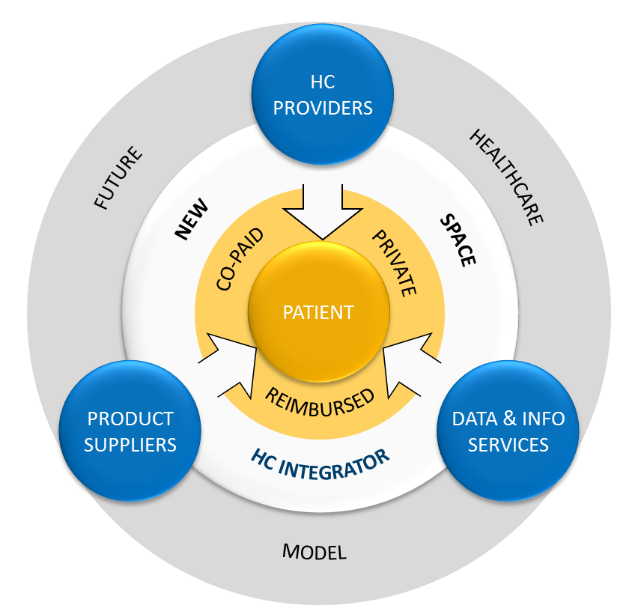

To start with the last question: It seems very logical that in the future the patient is going to be a, if not the main, funding source for add-on services and solutions. Parts within the integral solution that go beyond the fundamental therapy or treatment, for example elements that improve convenience of care and/or quality of life, could potentially be either co-paid or completely privately paid in the future. The good news is that this will bring a new additional funding mechanism into the healthcare system, but even more important, increase patient empowerment as well as patient centricity of health solution providers and suppliers. More about this in a later article.

The first question is the more interesting question for the mid-term. The ‘Battle for New Space’: who is going to be The Healthcare Integrator? Who is going to be the orchestrator bringing various products, services and data together into added value disease- and patient-centered solutions (see figure 2)? We have three, maybe even four, main candidates:

- Healthcare providers: This seems most logic, because they already have this position and are generally regarded to play this role. One disadvantage is that there is generally a lot of inertia and lack of entrepreneurship in the healthcare provider environment.

- Product suppliers: The life science industry has most interest to play this role. Their doom scenario is that they are put in a sole delivery role away from the patient and much appreciated data. They still need to prove they can be a trusted partner to play this integrator role.

- Data & information service providers: They have the power and speed to move. They are used to rapid prototyping and quick dynamics. These non-traditional players are definitely a stakeholder to take in serious consideration, either as a player who will fill the new space or as an essential strategic partner.

- Payers: What about the role of the payer? Are they going to be the big orchestrator? They will definitely be orchestrating indirectly, money talks, but will they also play a more active role. So far they have a ‘watch and see’ approach, but will they become more pro-active once this integrator market develops and becomes more mature?

Only time will tell which player(s) can best position itself as the Healthcare Integrator. Probably it will start with a mixed landscape with many initiatives mushrooming, later on to be consolidated by the most dominant players. One thing is for sure, we are facing very dynamic, challenging and interesting times in healthcare … If you want to become the Healthcare Integrator of the future, the time is now the prepare the ground. Define your therapeutic area of expertise, the value you could bring to the system, which stakeholders you would need to collaborate with, and get out there to start position yourself. The battle is on!