Stakeholders increasingly believe in outcomes-based contracting as an important lever towards collaboration on improved quality of care, improved value for money and a more sustainable health system.

The context of local Market Access

But what does this mean in a context of local Market Access, where pharmaceutical contracts are negotiated at a hospital-by-hospital level?

We have examined how outcomes-based contracting is currently being shaped between hospitals and pharmaceutical companies in the Netherlands. Here’s what specialists, hospitals pharmacists and hospital purchasers have to say. You will be surprised by their response. Or maybe not….

LOCAL HOSPITAL CONTRACTING OF SPECIALTY MEDICINES IN THE NETHERLANDS

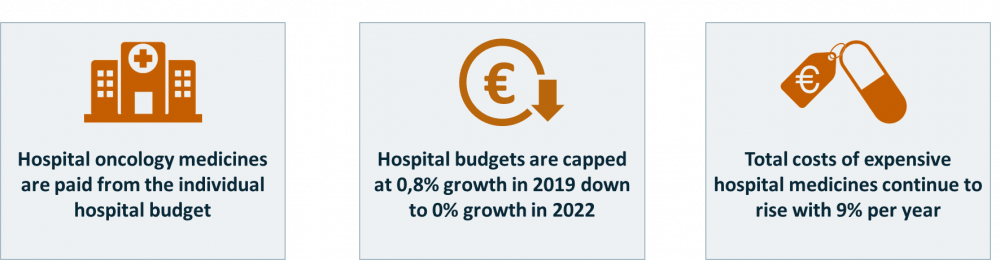

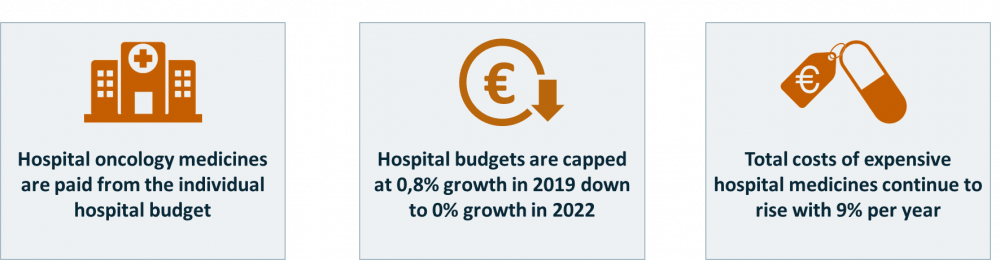

In the Netherlands uptake of specialty medicines often takes place based on contracts between pharma companies and individual hospitals that are negotiated in a context of budget pressure (see figure 1).

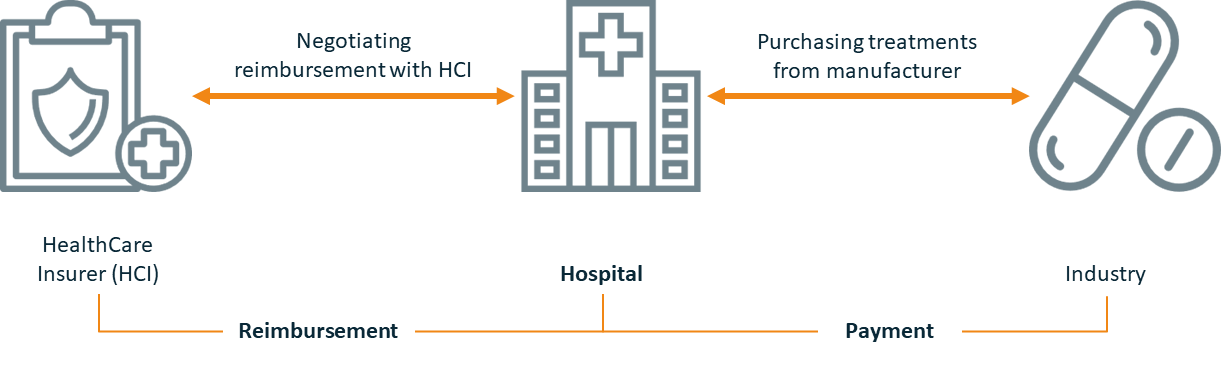

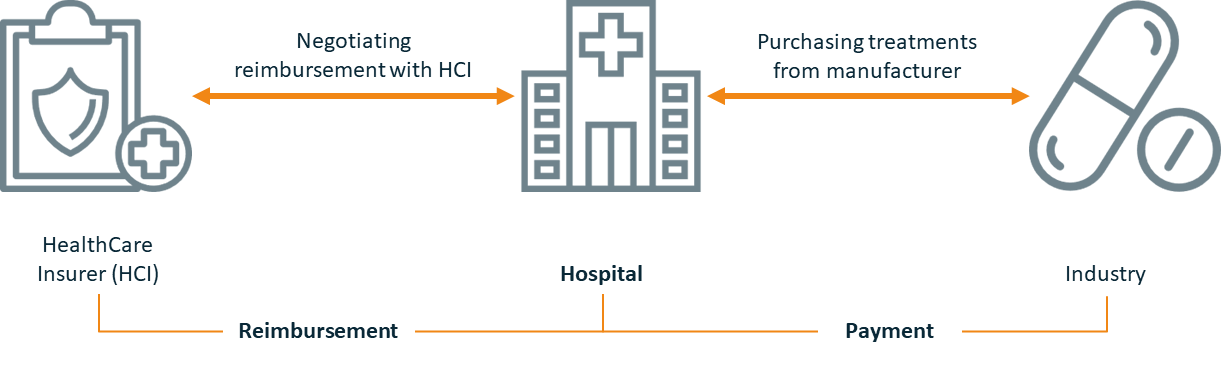

For hospitals to stay financially sound, it is key to limit the expenditures on specialty medicines and to negotiate the highest reimbursement level with the HealthCare Insurers (HCI) during the annual contracting cycle (see figure 2).

Hospitals try to achieve a purchase price from manufacturers which is equal to or lower than the reimbursement level applied by their healthcare insurers. They negotiate on both sides to avoid a negative gap between the two prices.

Additionally, they try to increase their purchasing power through membership of hospital purchasing groups, notably in disease areas where multiple companies compete based on price.

In this context, for hospitals predictability of volumes is key, since contracts with HCIs are often semi-fixed annual budget’ for care provided, based on expected number of patients. The objective of these semi-fixed budgets is to increase efficiency within the hospital in order not to exceed these budgets. Today, in practice, when the hospitals do exceed expected volumes, the insurers often step in to “compensate” for the additional costs.

treatmentS options ARE ON THE RISE, AS ARE HOSPITAL BUDGET CONSTRAINTS

The expectation is that this type of compensation will come to an end, thereby adding to the already increasing budget pressures. On top of that, the increasing number of treatment options in a context of downward pressure on hospital budgets comes with an increasing focus on pharmaceutical spending levels, pushing healthcare stakeholders away from each other.

The challenge is to find new ways of pricing and contracting for innovative medicines, especially in oncology and rare diseases, that are beneficial for health outcomes, innovation and health system sustainability while meeting stakeholders’ direct needs.

The promise of Innovative Agreements

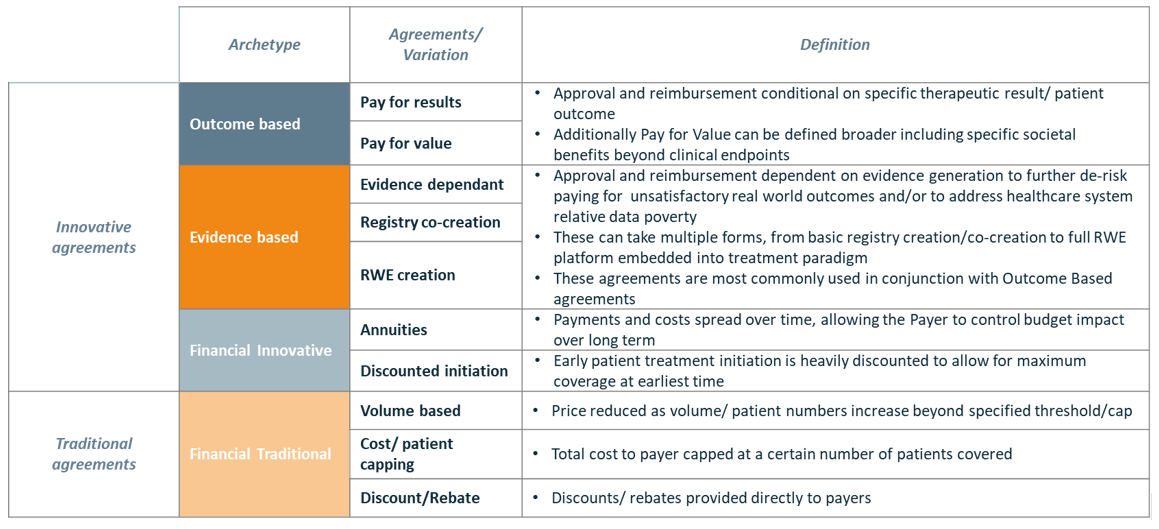

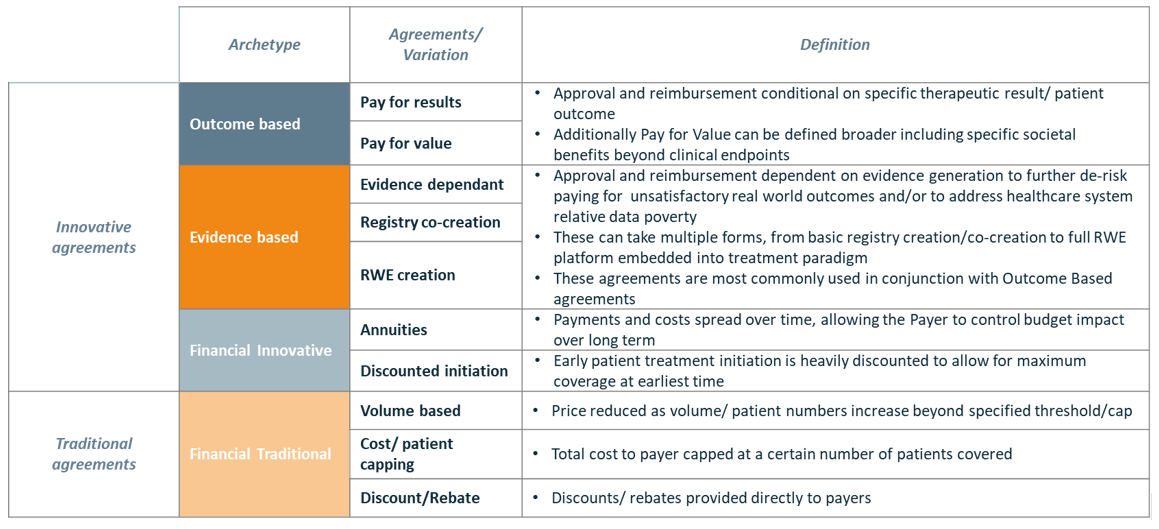

A multitude of Innovative Agreements – often initiated by the pharmaceutical industry – can potentially be used to ensure that hospitals receive optimal value for money, de-risk uncertainty by collecting evidence on real-world value and/or reduce the budget impact of purchasing an innovative therapy. We have categorized these Innovative Agreements in 3 “archetypes” to show the differences also in comparison to Traditional Agreements (See table 1).

We examined if and how innovative contracting is currently taking off between hospitals and pharmaceutical companies in the Netherlands – and if and how Innovative Agreements can live up to their promise, to bring stakeholders together and close the fundamental gaps in the Dutch Healthcare system.

HOSPITAL CONTRACTING PREFERENCES

Vintura has been doing research amongst 30+ pharmacists, buyers and healthcare professionals to understand hospital preferences for agreements with pharmaceutical companies. Although 50% of hospitals have some experience with Innovative Agreements, we found there is limited ‘adoption’ of and preference for Innovative Agreements by hospitals (see Figure 3). Because Innovative Agreements do not meet their needs. For Dutch hospitals ‘not meeting their needs’ means:

- Hospitals have a clear drive towards simplicity in contracting, as hospitals purchase a large variety of drugs every year.

- Hospitals perceive the required administrative burden to manage Innovative Agreements as too time consuming and hence costly.

- Hospitals often perceive the ‘reward’ provided as unclear and don’t feel that they will pay a lower price in the end.

Hospital stakeholders tend to assume that the added value does not to balance the extra burden. A lack of trust in the pharmaceutical industry plays an important role here.

The result is that the good old ‘flat discount on list price’ agreement or the ‘staggered discount’ often surfaces again at the end of the contracting cycle instead of a truly innovative contract.

MAKING INNOVATIVE AGREEMENTS WORK AT the HOSPITAL LEVEL

Stakeholders increasingly believe in outcomes-based contracting as an important lever towards collaboration on improved quality of care, improved value for money and a more sustainable health system. What does this mean in a context of local Market Access, where pharmaceutical contracts are negotiated at a hospital-by-hospital level?

In the Dutch context of local Market Access, Innovative Agreements are being set up at a small scale, based on individual hospitals preferences. One could question whether this system leads to optimal efficiency and equality in access for patients.

But we also see in the Netherlands that setting up Innovative Agreements at the local hospital level is possible. However, the multi-stakeholder process is time-consuming and requires trust, mutual respect, collaboration and initial investment (in resources and potentially measurement tools) while long term gains are not always deemed to be evident. Consequently, despite growing willingness and serious attempts, Innovative Agreements between hospitals and pharmaceutical companies are taking off quite slowly.

Innovative Agreements are needed to evolve towards a value-based system and clearly have the power to de-risk uncertainties about the real-world value of an innovative therapy. Plus, they are an important lever for collaboration towards the same goal: optimal value for patients. In order to achieve this, several hurdles must be overcome in order to give Innovative Agreements a prominent place in the annual contracting cycles.

The following success factors need to be considered

3 success factors for hospitals

- Make measuring of patient outcomes part of the regular hospital infrastructure and management. It will pay off financially and will generate insights that improve the quality of care and life of patients.

- In pharmaceutical contracting, ensure a balance between the short-term need for simplicity and the medium- and long-term need to transition towards value-based healthcare.

- Start piloting with those companies where there is trust, and where ambitions and objectives can be aligned through open and constructive communication. And learn from it, as learning and innovation go hand in hand.

3 success factors for pharmaceutical companies

- Propose simple Innovative Agreements with limited additional data collection/analysis requirements.

- Focus on agreements that minimize risk and maximize predictability, both in terms of pharmaceutical expenditure and obligations related to the Innovative Agreement.

- Start piloting with those hospitals where there is trust, and where ambitions and objectives can be aligned through open and constructive communication. And learn from it, as learning and innovation go hand in hand.

Remember Thomas Edison’s quote: “I have not failed.

I’ve just found ways that won’t work”.